Insurance Solutions for Climate Change Risks: Implications for Universities

Climate change presents universities with unprecedented challenges, ranging from extreme weather events to long-term environmental shifts. As institutions deeply embedded in their communities and committed to sustainability, universities are increasingly vulnerable to these risks. However, amidst these challenges lies an opportunity for proactive risk management through innovative insurance solutions tailored to the complexities of climate change.

Climate change presents universities with unprecedented challenges, ranging from extreme weather events to long-term environmental shifts. As institutions deeply embedded in their communities and committed to sustainability, universities are increasingly vulnerable to these risks. However, amidst these challenges lies an opportunity for proactive risk management through innovative insurance solutions tailored to the complexities of climate change.

### Understanding the Risks

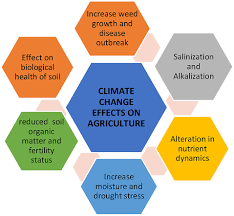

Universities are hubs of education, research, and community engagement, making them highly susceptible to climate-related disruptions. Rising sea levels threaten coastal campuses, while inland institutions face increased risks of wildfires, floods, and severe storms. Moreover, changes in temperature and precipitation patterns can impact infrastructure, research facilities, and the well-being of students and staff.

### Traditional Insurance vs. Climate Risk Insurance

Traditional insurance models often fail to address the unique and evolving nature of climate risks. They typically focus on indemnifying losses from discrete events rather than anticipating and mitigating future risks. In response, climate risk insurance offers a more comprehensive approach by integrating climate science, predictive modeling, and adaptive strategies into risk management frameworks.

### Tailored Solutions for Universities

For universities, adopting climate risk insurance involves several strategic considerations:

1. **Risk Assessment and Mitigation:** Insurers can collaborate with universities to conduct detailed risk assessments that identify vulnerable areas and assets. This data-driven approach helps prioritize mitigation efforts, such as upgrading infrastructure to withstand extreme weather or relocating critical facilities away from high-risk zones.

2. **Financial Protection:** Climate risk insurance policies are designed to provide financial protection against a broader range of climate-related events. This includes coverage for property damage, business interruption, and liability arising from climate impacts.

3. **Incentivizing Adaptation:** By aligning insurance premiums with proactive adaptation measures, insurers can incentivize universities to invest in climate-resilient infrastructure and sustainable practices. This not only enhances resilience but also supports broader climate action goals.

4. **Collaborative Partnerships:** Universities can leverage their collective influence through consortiums or partnerships to negotiate favorable terms and conditions for climate risk insurance. This collaborative approach fosters knowledge sharing and innovation in climate adaptation strategies across the higher education sector.

### The Role of Innovation and Research

Insurance solutions for climate change risks are continually evolving through innovation and interdisciplinary research. Universities, as centers of knowledge creation, play a pivotal role in developing new risk assessment tools, advancing climate modeling capabilities, and exploring novel insurance products tailored to specific regional and institutional needs.

### Conclusion

As climate change intensifies, universities face growing imperatives to integrate robust risk management practices into their strategic planning. Climate risk insurance offers a proactive and adaptive framework to safeguard campuses, sustain operations, and uphold commitments to sustainability and community resilience. By embracing innovative insurance solutions, universities can lead by example, inspiring broader societal efforts to mitigate and adapt to the impacts of climate change.

In summary, the journey towards climate resilience requires universities to embrace collaboration, innovation, and proactive risk management through tailored insurance solutions. By doing so, they not only protect their own interests but also contribute to a more resilient and sustainable future for generations to come.